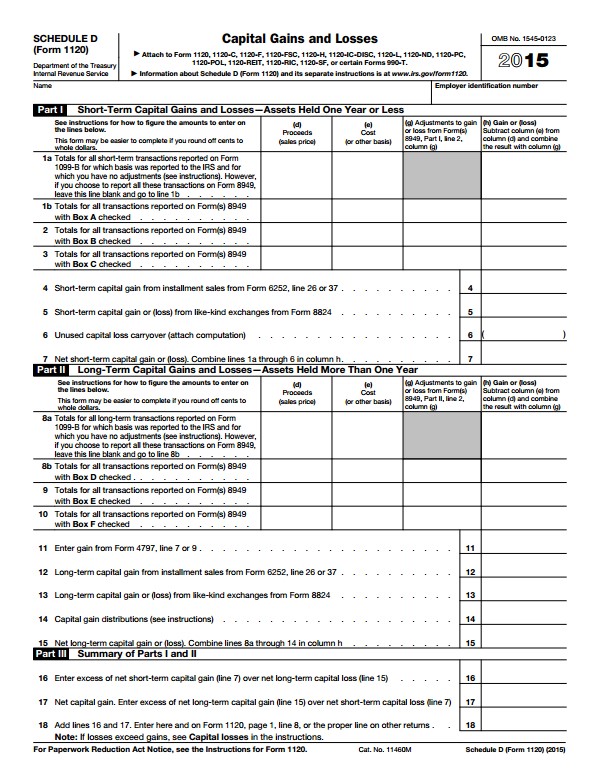

Fillable Form 1120 Schedule D (2015-2016)

Form IRS 1120- Schedule D is used to record the capital gains and losses that are not reported on Form 1120. S corporations use Schedule D to report state capital gains and losses, gains on distribution to shareholders of appreciated capital assets.

FILL ONLINE

EMAIL

SHARE

ANNOTATE

Form was filled-up and downloaded

1,004times already

Keywords

- 1120 schedule D

- 1120-schedule D

- 1120 schedule d

- 1120-schedule d

- IRS 1120 schedule D

- irs form 1120 schedule d

- form 1120 schedule D

- 1120 schedule-d form